�Ķ���һ������ :: �Ķ���һ������

����

����

d.app ֻ������ )

2011-4-27 15:08

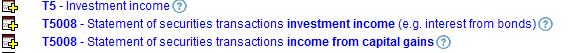

���һ�´�� ��û����ufile��˰�ģ��е�ͬѧ��ָ���� Investment Income ���� ������Ʊ����Ļ���Ҫ��T5008�ɣ�

¥�� |

����ֱ��

��̳���

Richmond Signature ���Դᆱѡ��������0%, �ټ�$�ر��ۿۣ�

-3213- ֻ������ )

2011-4-27 20:23

���Ǵ�ufile�ϵ�help�����ģ�

ɳ�� |

���ض���

��̳��ҳ

-> Ͷ������ ���е�ʱ���Ϊ ����̫ƽ��ʱ��

��1 ҳ����1 ҳ

ע��������̳���з��Խ����������߸��˹۵�, ����������վ�۵������, �������Դ˲����κ����Ρ� Ͷ�����Ƽ���������������Ӳ�����Ͷ�ʽ��顣Ͷ���з��գ��������Ը� �Զ��������е������Ϣ�������еľ��Ⱦ��뱾վ�ء�

������ �ڱ���̳�������������� �ڱ���̳�ظ��������� �ڱ���̳�༭�Լ����������� �ڱ���̳ɾ���Լ����������� �ڱ���̳����ͶƱ���� �������̳���Ӹ������� �������̳�����ļ�

��̳ת��:

ѡ��һ����̳

������ ����֪��

��������

������

�����ķ�ɳ�ӹ�

�ز�Ͷ��

������

�̺���

�ⷿ��Щ�¶�

�ӹ�һ����

���DZ��ñ�

�¸绪����ҹ

���µ���

����Langley

��������

������

�����¼�

��ʯ����

��������

����ɳ��

������Ե

��ʱ��֮��

��ӭ��������

�Ұ�������

�߹��ֵ�������

��Ӣ˫�����Walton Elementary

�����

����̽��

ҽ�ƽ���

������

�������.��ҽ����

�����ղ�

����

Ͷ������

���ӽ���

���������ֲ�

�������

�´�Jeep֮��

Ǯ�ҽ���Сվ (Coin Community)

��Ѹ��˹��

��Ա֮��

������֮��

��Э

�Ժ������� ��������

����ȺӢ��ͧ��

�������

������ֲ�

����Hiking

�ԳԺȺ�

����֮��

�������

��ͨ��ѧУ�ѻ�

����ͬ���ڴ˾ۼ�

���ô��Ĵ�ͬ�������

ͬ�ô�ѧ�¸绪У�ѻ�

������ͼ

����������

����һЦ

��������� ����ʱ��

�������

��ʦ�չ�

������ѡ

��ϵ�й�

��������

���ռ��

�����˼�

���ƻ���

ֻ���Ϻ���

����ͼҹδ��

������ɳ�� ԭ��ԭ��

��Ӱ����

��ʯ����Ӱ����

��������

����Ժ - ���ϲȵ��

���ӵ���

Twitter ����

ƻ����

android���ǿ�

�����ֻ��ƻ�

�����ͻ

��������̳

��վ����

�߸�С�顪LINUX

IT����

iTalkBB������

English Corner

��������� ���üҾ�

��������

������Ѷ

�¸绪��ѧ

������

�¸��봴ҵ ��������

�Ų��鱦

���¹���

��ҵɳ��

ְ������

�˶������� ��ë��

�߶�����ֲ�

�����˶�

������ѩ���ֲ�

������Ӿ���ֲ�

����֮��

����̨������칫��

����Χ����ֲ�

�������

��������

ƹ����

��������� ��ĩ����

���ƿ���

��ױ

������ʳ

�¸绪�߶���

d.app, -3213-

�������� �������� ��������

��������ѧʧ��?��Ů����ȫ�ҵ� ���������ٲ÷�ͥ:ά�ֶ��й����˹ھ������� ���������ٲ�ͽ��ʧ������ ������ ���ձ�Ȧ���� ���˿��� ������ȥ�Ҵ� �������ͷ ����ѫ�ӳ� "�"�ɼ�һϦ����164�� �ؽ�������������ѡ ���ճ����齣ָ������? ӡ�ȷ����ɷ����ƹ�Ī��,����1962����ӡ֮ս �´��⺣�̹۾���ر� ��ͨ���е� Ӣ��Ů�ο;���ϣ����������ֹ��� ������ŭ ����̸����Ҫ����,�й�ʹʧ�����ձ��Ĵ���� "������"�ں�̲�ſհ���,��½��18��ʿ����ְͣ �����ί���ֺ����쳣 �������пֲ�һ�λ� ���������ڱ�����������ס����������,�������� �й�������˽��Ƶ������˷ܼ��������Ա����� �������й��˾��� ���ڻ�����ƴӲ�������й� ��ɱ�� ��ɱ�� ����ɱ���� ���º��� ��������ָ����α����?��������������ֱ����Ц 3���¾翪��,����ˮ��ͤ��6.3,��������6.4,��ѧ���װ����� ���鿥�����鹫�����汾:�ձ�����ʷ��̱�,��������ֱָ���� ��һ������ô�̼�,ħŮ����һ������ˬ�� ��Ӧ��Ů��!23��ǰ�۽����37���ӵ��������� ��ҳ�Ϊ�ӱ���෭: ִ������ͷʻ��δʩ�� ��ӱ�ź�����˼�,����ҵ�ٺò�����㺢�ӳ��� �����Ľ���400����ԪӢΰ��оƬ ��ɺ�̺��¶��λ,����͢��俿���,Cλ���˸��� ����������ֵ,��Ӱ���ҿ��������� ��Ƶ�����,����"�г���ҩ"��η���? ������2025���ڶ��ڹۺ��,�����������120��! �ӳ���������:����ͷ������Ӱ�ܽ�����Ƭ������? ��˹���ش�S�����������ͼ:֪����ʵȴ�����ڸ� ������ĩ���ͻ���д���·��· ������еij��� Ǯ����Ҫ�ӵ�˰�� ������Ů����������ѧ ���䲻�� �´廪��Ů��ǩ��thebay�ŵ���Լ ����ɱ�����⼮�� �й��⽻��:��ά����ѧ��Ȩ�� ����11���ƺ���ת�̱��� 2��Ϸ����δ�� ��ֻ iPhone 6�µ�ȫ�濪���������ֻ���˰ ���б�ײ��һ����� ������������ ���ô�������ֹ�Ӱ� ��������ӳ� �����رճ� ��һ�ձ��ݽ��ر� 3���¾翪��,����ˮ��ͤ��6.3,��������6.4,��ѧ���װ����� ���鿥�����鹫�����汾:�ձ�����ʷ��̱�,��������ֱָ���� ��������ָ����α����?��������������ֱ����Ц ��һ������ô�̼�,ħŮ����һ������ˬ�� ��Ӧ��Ů��!23��ǰ�۽����37���ӵ���������

��̳ͨ��:

��̳ͨ��:

���˿ռ�:

���˿ռ�:

��̳ת��:

��̳ת��:

��

��  ����

����  Ͷ��

Ͷ�� ��

��  ����

����